Learn with Us

- Investing: Basics

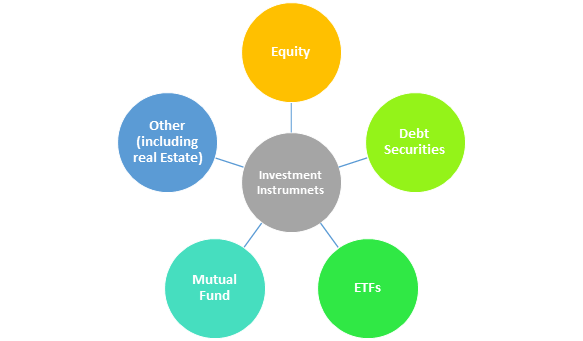

- Types Of Investment Instruments

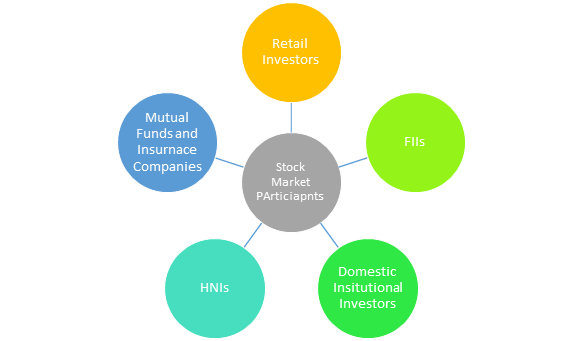

- What exactly is the stock exchange?

- Stock Market Regulators

- What Is An Initial Public Offering (IPO)?

- What Is Depository?

- Market Jargons

- Fundamental Analysis

- What is an annual report?

- Financial Statements

- The profit and loss statement

- Balance Sheet

- The Cash Flow statement

- Financial Ratio

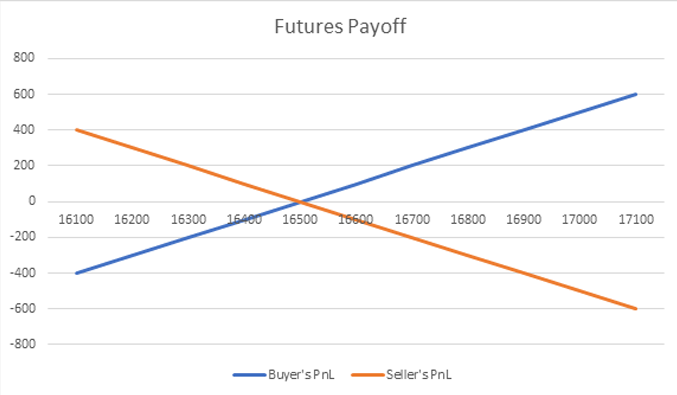

- What are futures

- Important Futures Contract Terminology

- Index Futures and Stock Futures

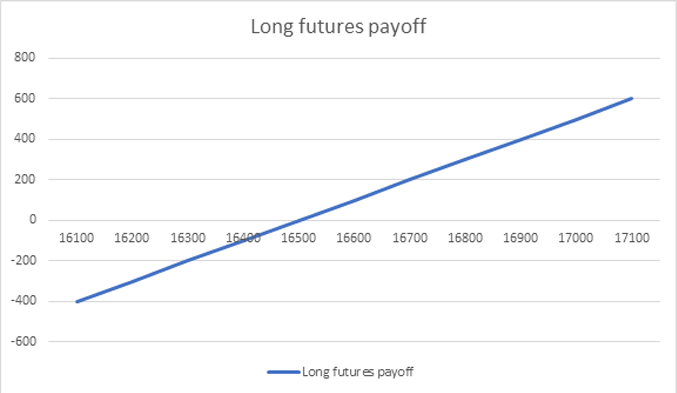

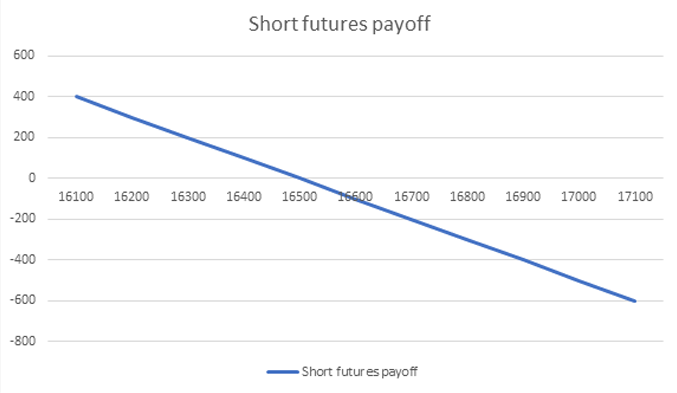

- Futures Payoffs

- Margins

- Long and short futures

- Rollover

- Hedging

- Physical Settlement

- Option

- Call options

- Call option seller

- Put Option

- Put option seller

- Moneyness of an Option Contract

- The Option Chain

- What are Option Greeks?

- Personal Finance Basics

- Process:

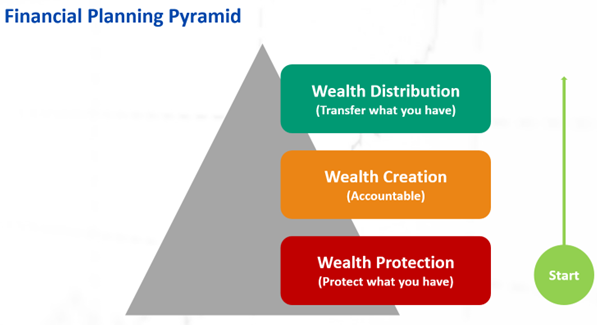

- Financial Planning Pyramid

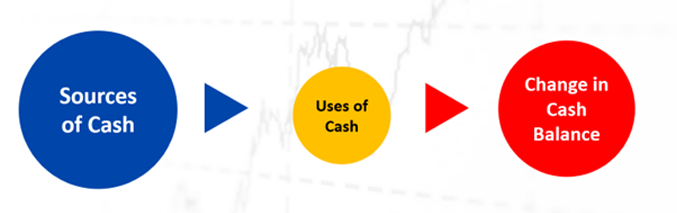

- Cash Flow Analysis (Current Status)

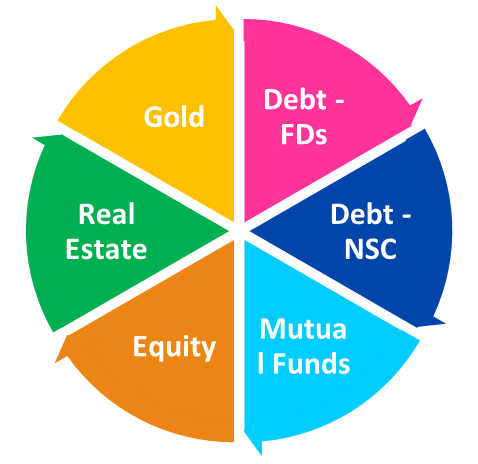

- Current Asset Allocation

- Risk profiling

- Emergency funds

- Investment Planning for Goals

- Insurance

- The Fundamentals of Income Tax Structure in India

- Mutual Fund

- Mutual Fund Ratios

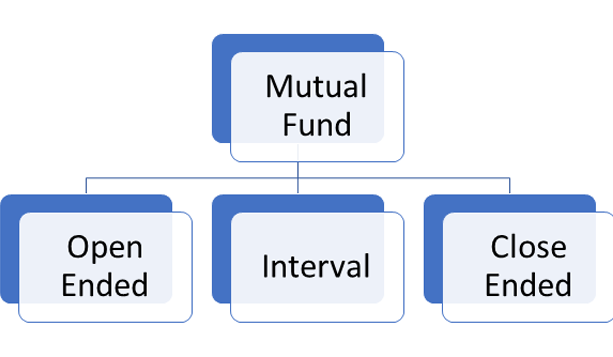

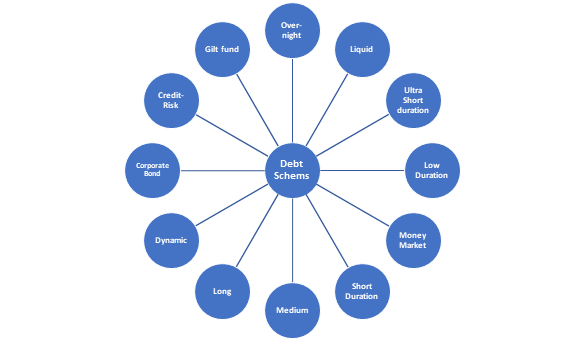

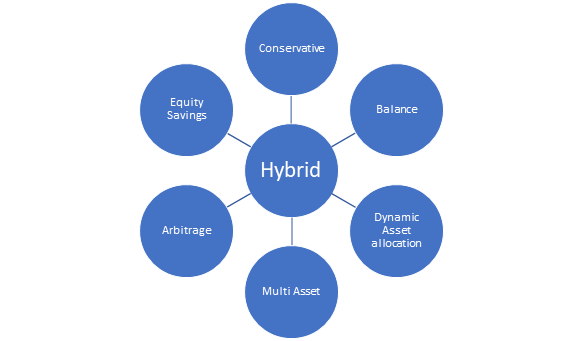

- Mutual Fund Types in India

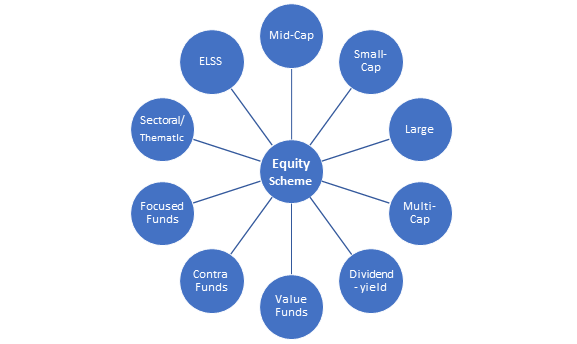

- Mutual Fund Schemes

- What exactly is an Exit Load, and why is it imposed?

- Mutual Fund Jargons

Option

It is a contract in which one party (the holder or buyer) has the right, but not the responsibility, to execute the contract (the option) on or before a specific date in the future (the exercise date or expiry). The other party (the writer or seller) is obligated to honor the contract's stipulated feature.

Buying and selling options contracts in the F&O market is the most basic options trading method. It involves two parties: the option writer and the option buyer. Technically, the writer is taking on extra risk. As a result, he obtains a premium, which the buyer must pay. It assures that if the market turns against the writer and the options contract expires worthless, the buyer's losses do not exceed the premium paid.

Options are classified as 'call' or 'put.'

Let's go through the fundamentals of call and put options and try to comprehend how they work.

Call options

Call options provide the buyer the right to acquire the underlying asset at a certain price on a specific day. Meanwhile, if the buyer chooses to exercise his right, the seller is compelled to sell the item at the predetermined price on the predetermined day.

An example of a call optionA call option grants the option buyer the right to purchase an asset. The seller of the option, on the other hand, has no such right and is required by the option contract to sell the asset to the buyer (if the buyer exercises his right to purchase).

In exchange for effectively giving up his rights, the seller of the option charges the option buyer a fee known as the 'premium.' Consider this 'premium' amount to be a form of security deposit charged by the option seller to compensate himself if the buyer does not exercise his option.To further understand the concept of call options, consider the following example.

Assume Reliance is currently trading at Rs. 2500. You anticipate that the price of this stock will rise in the near future, say one month from now. So you want to lock in the present price today so that you can buy at this cheap price later.

However, you are naturally cautious, so you want to account for the other scenario as well - what if prices decrease instead? So, in essence, you want the option (rather than the duty) to purchase Reliance at Rs. 2500 in the future.

This is where an options contract can come in handy. A call option is a type of options contract that offers you the right to acquire an asset at a preset price on a future date.

Meanwhile, another trader, Yagya, believes that the price of Reliance shares would fall in the near future. In other words, he wants to engage into a contract that will allow him to sell the share one month later at Rs. 2500 since he feels the prices will be significantly lower at that time.

This price (Rs. 2500) is known as the strike price of the option.

So the two of you sign a contract. Yagya sells you a call option. In other words, you buy the right to buy a Reliance share from him one month from today for Rs. 2500.

You anticipate that the price will be more than Rs. 2500 at that point. Meanwhile, Ram sells you the right to buy a share of Reliance for Rs. 2500.

You are both the buyer of the options contract and the buyer of the asset in this case. And Yagya is the seller of both the options contract and the asset.

As a result, Yagya has effectively obligated himself to sell you the shares. Yagya will charge you a premium of say Rs. 20 as compensate for any loss he may experience if you do not exercise your choice.

We will attempt to formalise our thinking on the call option and gain a solid understanding of both the buying and selling of the call option.

Before we go any further, here is a quick rundown of call option buyer

- • When you expect the underlying price to rise, it makes sense to purchase a call option.

- • If the underlying price remains unchanged or falls, the buyer of the call option loses money.

- • The money lost by the buyer of the call option is equal to the premium (agreement fees) paid to the seller/writer of the call option.

For sake of understanding let’s take example of HUL,

It has been beaten down from its September highs and made a low of 1900 levels which is quite unsustainable for it; as results have been favourable so you decided to buy a call option of 2000 strike price of may month ,as you want least premium decay.

Now lets say you bought it at 80 , your payoff on expiry would be as follows , based on the intrinsic value of the option.

| HUL price | Buy Price | Intrinsic Value | PnL |

|---|---|---|---|

| 1850 | 80 | 0 | -80 |

| 1900 | 80 | 0 | -80 |

| 2000 | 80 | 0 | -80 |

| 2100 | 80 | 100 | 20 |

| 2200 | 80 | 200 | 120 |

| 2300 | 80 | 300 | 220 |

Intrinsic value for a Call Option is calculated as

INTRINSIC VALUE =CURRENT PRICE – STRIKE PRICE

Note: Intrinsic Value can never be negative/ less than zero. Now consider why intrinsic value cannot be less than zero.

We know that the highest amount of money you can lose in option buying I restricted to the amount of premium paid. It is because options contracts allow traders to choose whether or not to exercise the contract. A trader will only exercise an option or make a decision if it is profitable for him. If he is losing money, he will let the options expire worthless and lose the price paid for the option. He will not lose any more money than the premium paid when he purchased the contract.

So, we may conclude that the maximum loss for an option buyer is limited whereas the maximum profit for him is unlimited; the break even for him would be equal to premium paid in addition to the strike price.

Call option seller

However, keep in mind that whatever occurs to the option seller in terms of the P&L, the exact reverse happens to the option buyer and vice versa. For example, if the option writer profits Rs.70/-, this automatically implies that the option buyer loses Rs.70/-.

Here's a quick rundown of some of them:

- • If the option buyer's risk is restricted (to the extent of the premium paid), the option seller's profit is also limited (again to the extent of the premium he receives)

- • If the option buyer has an endless profit potential, the option seller may have an unlimited risk.

- • The breakeven point is the moment at which the option buyer begins to profit; it is also the point at which the option writer begins to lose money.

- • If the option buyer makes Rs.X in profit, it indicates that the option seller loses Rs.X.

- • If the option buyer loses Rs.X, it means that the option seller profits Rs.X.

- • Finally, if the option buyer believes that the market price will rise (above the strike price in particular), the option seller believes that the market price will remain at or below the strike price...and vice versa.

If we consider the same example with sellers’ point of view, the PnL would be something like this: -

| HUL price | Buy Price | Intrinsic Value | PnL |

|---|---|---|---|

| 1850 | 80 | 0 | 80 |

| 1900 | 80 | 0 | 80 |

| 2000 | 80 | 0 | 80 |

| 2100 | 80 | 100 | -20 |

| 2200 | 80 | 200 | -120 |

| 2300 | 80 | 300 | -220 |

We can conclude from here that the profit of a call option seller is capped at 80 but his losses can run down to infinity. A call option buyer will earn a profit till price at expiry is less than premium paid in addition to Strike price which is 2000+80 for HUL.

Albeit your max profit is fixed at 80, but your losses aren’t.

Put Option

A put option (or "put") is a contract that grants the option buyer the right, but not the responsibility, to sell a predetermined amount of an underlying securities at a predetermined price within a predetermined time frame. The striking price is the predetermined price at which the buyer of the put option can sell the underlying security.

The buyer's outlook on markets should be negative in a put option, as opposed to the buyer's bullish view in a call option.

A put option agreement allows the buyer to purchase the right to sell a stock at a predetermined price (strike price), regardless of the current trading price of the underlying.

Remember this generalisation: whatever the buyer of the option anticipates, the seller anticipates the exact opposite, implying the existence of a market. After all, a market cannot exist if everyone expects the same thing. So, if the Put option buyer anticipates the market to fall before expiration, the Put option seller expects the market (or the stock) to rise or remain flat.

A put option buyer purchases the right to sell the underlying to the put option writer at a set price (Strike price). This means that the put option seller will have to buy if the 'put option buyer' is selling him at expiry. Take note: at the time of the agreement, the put option seller is selling a right to the put option buyer to 'sell' the underlying to the 'put option seller' at the time of expiry.

Confusing? Consider the 'Put Option' to be a simple contract in which two parties meet today and agree to enter into a transaction based on the price of an underlying asset: -

The party agreeing to pay a premium is referred to as the 'contract buyer,' while the party receiving the premium is referred to as the 'contract seller.'

The contract buyer pays a premium to acquire a right.

The contract seller receives the premium and becomes obligated.

On the expiry day, the contract buyer will determine whether or not to exercise his entitlement.

If the contract buyer exercises his right, he is entitled to sell the underlying (perhaps a stock) at the agreed-upon price (strike price), and the contract seller is compelled to purchase the underlying from the contract buyer.

Obviously, the contract buyer will exercise his right only if the underlying price is trading below the strike price – this means that the buyer can sell the underlying at a much higher price to the contract seller despite the fact that the same underlying is trading at a lower price in the open market.

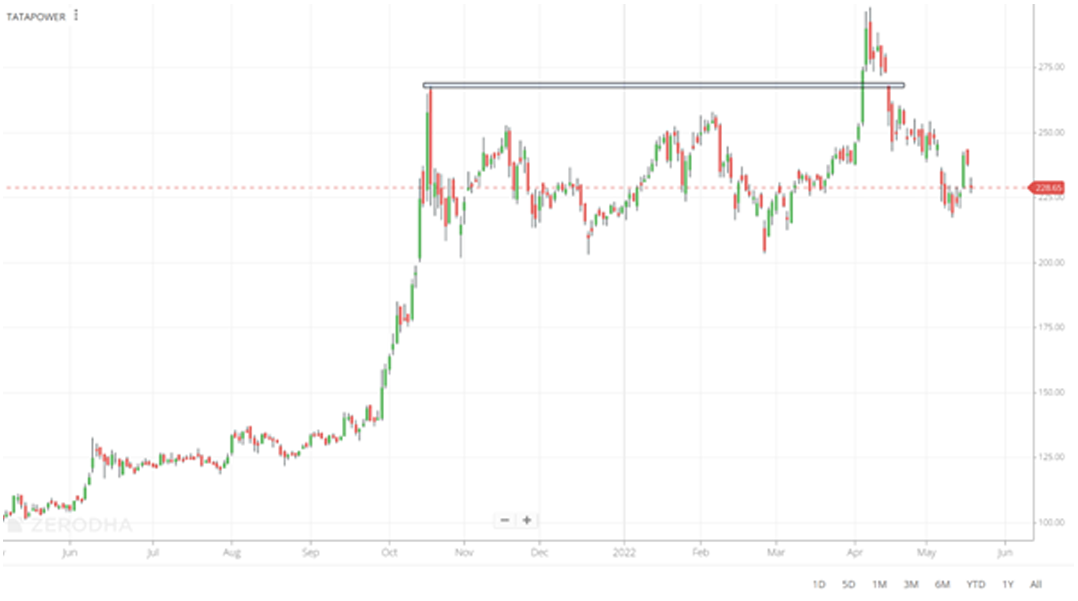

Tata Power was trading at all time high, but it started showing some weakness at the top , at first we assumed that it may be some profit booking , but on 18-04-2022 both indices opened lower and Tata Power broke its major support , it consolidated around 250 levels which is also an important area , but weakness persisted. So on this rational lets say you took a trade with Options, You bought 250 PE at 5, when tata power was trading at 260

| TATA Power Price | Buying PRICE | INTRINSIC VALUE | PnL |

|---|---|---|---|

| 280 | 5 | 0 | -5 |

| 270 | 5 | 0 | -5 |

| 270 | 5 | 0 | -5 |

| 260 | 5 | 0 | -5 |

| 250 | 5 | 0 | -5 |

| 240 | 5 | 10 | 10 |

| 230 | 5 | 10 | 20 |

If you will look at this you will find that Maximum Loss is Capped at 5 but maximum profit potential is unlimited(or limited to the extend till the underlying erodes its value to zero).

Intrinsic Value for a Put Option equals to Strike Price – Current Price.

Option Buyer will start making money after the current market price is less than the premium paid in addition to the strike price.

Put option seller

However, keep in mind that whatever occurs to the option seller in terms of the P&L, the exact reverse happens to the option buyer and vice versa. For example, if the option writer profits Rs.7/-, this automatically implies that the option buyer loses Rs.7/-.

Here's a quick rundown of some of them:

- • If the option buyer's risk is restricted (to the extent of the premium paid), the option seller's profit is also limited (again to the extent of the premium he receives)

- • If the option buyer has an endless profit potential, the option seller may have an unlimited risk.

- • The breakeven point is the moment at which the option buyer begins to profit; it is also the point at which the option writer begins to lose money.

- • If the option buyer makes Rs.X in profit, it indicates that the option seller loses Rs.X.

- • If the option buyer loses Rs.X, it means that the option seller profits Rs.X.

- • Finally, if the option buyer believes that the market price will rise (above the strike price in particular), the option seller believes that the market price will remain at or below the strike price...and vice versa.

If we consider the same example with sellers’ point of view, the PnL would be something like this: -

| TATA Power Price | Buying PRICE | INTRINSIC VALUE | PnL |

|---|---|---|---|

| 280 | 5 | 0 | 5 |

| 270 | 5 | 0 | 5 |

| 270 | 5 | 0 | 5 |

| 260 | 5 | 0 | 5 |

| 250 | 5 | 0 | 5 |

| 240 | 5 | 10 | -10 |

| 230 | 5 | 10 | -20 |

We can conclude from here that the profit of a put option seller is capped at 5 but his losses can run down to infinity. A put option buyer will earn a profit till price at expiry is less than premium paid in addition to Strike price which is 245 for TATA Power.

Albeit your max profit is fixed at 5, but your losses aren’t.

Moneyness of an Option Contract

An option contract's moneyness is a categorization approach in which each option (strike) is classed as either, In the money (ITM), At the money (ATM), or Out of the money (OTM). This classification assists traders in determining which strike to trade given a specific market situation.

This classification is based upon current market price/ spot price of the underlying and intrinsic value of options.

Intrinsic Value of a Call option = Spot Price – Strike Price

Intrinsic Value of a Put option = Strike Price – Spot Price

Understanding strike classification, is fairly simple. All you have to do is calculate the intrinsic value. If the intrinsic value is greater than zero, the option strike is deemed 'in the money.' If the intrinsic value is zero, the option strike is referred to as being 'out of the money.' The strike that is closest to the Spot price is referred to as 'At the money.'

The Option Chain

The option chain is a feature found on the majority of exchanges and trading platforms. The option chain is a form of quick reckoner that helps you find all of the strikes that are available for a specific underlying and categorises the strikes based on their moneyness. Furthermore, the option chain offers information such as the Last Traded Price (LTP), volumes, open interest, and so on for each option strike.

This is option chain of Nifty, after observing we can conclude the following–

- 1. The Call options are located on the option chain's left side.

- 2. The Put options are located on the option chain's right side.

- 3. In the centre of the option chain, the strikes are stacked in increasing order.

- 4. All option strikes lower than ATM options are ITM options for call options. As a result, they have a pale-yellow background.

- 5. All option strikes higher than ATM options are OTM options for Call options. As a result, they have a white background.

- 6. For Put Options, all option strikes greater than ATM are ITM. As a result, they have a pale-yellow background.

- 7. For Put Options, any option strikes less than ATM are OTM. As a result, they have a white background.

- 8. The pale yellow and white background is simply a segregation tool for separating the ITM and OTM possibilities.

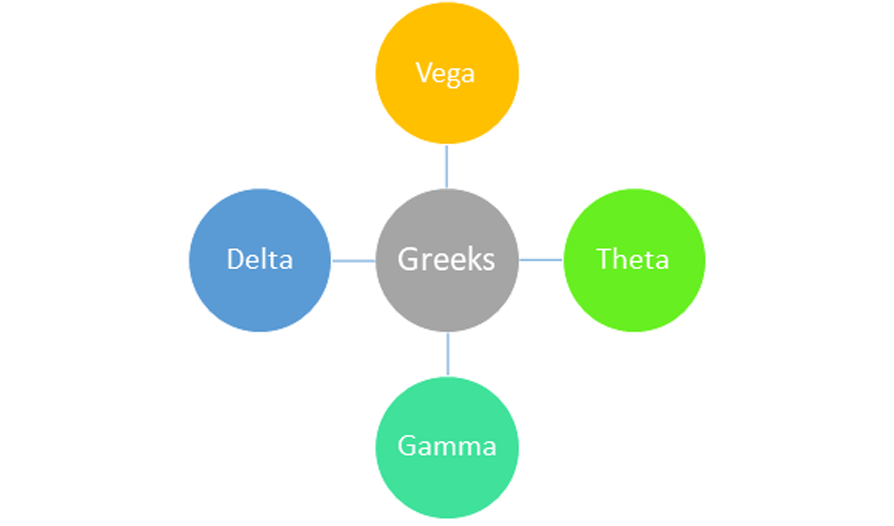

What are Option Greeks?

These are distinct measurements that help traders understand how the price of an options contract reacts to various influencing circumstances. They are also known as options Greeks. Greeks have three primary possibilities, which are outlined below

- • Delta

- • Gamma

- • Theta

- • Vega

Delta

You are aware that an options contract is a type of derivative. That is, its value is derived from the underlying asset. So, if the underlying asset's price changes, the price of the options contract (or its premium) changes, right? The delta measures the change in the premium of an option contract.

Delta: MeaningTechnically, the delta of an options contract is defined as the rate of change in the option's price in relation to changes in the underlying asset's price. It represents an option's directional risk.

What exactly is directional risk? That is, the delta indicates how much the price of an option will vary when the price of the underlying asset changes in a specific way (up or down).

The option price of a call option rises as the price of the underlying asset rises (and vice versa). The option price for a put option falls as the underlying asset's price rises (and vice versa).

In other words, the call option's price goes in the same direction as the underlying asset's price, but the put option's price moves in the opposite direction.

Here's an example to help you understand. Consider call and put options with ITC’s shares as the underlying asset.

| A | B | C | D | E |

|---|---|---|---|---|

| Type of option | Option price(in rupees) | Option delta | Option price if the share price increases by Re. 1 (in rupees)(B+C) | Option price if the share price decreases by Re. 1(in rupees)(B-C) |

| Call | 5.00 | +0.75 | 5.75 | 4.25 |

| Call | 2.50 | +0.30 | 2.80 | 2.20 |

| Put | 3.00 | -0.25 | 2.75 | 3.25 |

| Put | 4.00 | -0.60 | 3.40 | 4.60 |

A call option's delta is always between 0 and 1. (same direction movement).

And the delta of a put option is always between 0 and -1. (opposite direction movement).

And the delta of a put option is always between 0 and -1. (opposite direction movement).

The delta of an options contract is always changing. It also does not fluctuate in a linear fashion. So, how do you evaluate this delta change? This is when gamma comes in handy.

The definition of gammaThe gamma of an options contract is defined as the rate of change in the option's delta in response to changes in the underlying asset's price. In other words, it is the projected change in an option's delta relative to 1-rupee fluctuations in the underlying asset's price. It denotes a shift in the directional risk of an option.

To understand gamma, we must first examine how the delta of an option varies when the underlying asset's price changes. This is the typical trend for delta change.

When the asset's price rises, the delta of a call option rises as well (and vice versa).

When the asset's price rises, the delta of a put option decreases (and vice versa).

In other words, the delta of a call option moves in the direction of the underlying asset's price, but the delta of a put option travels in the other way.

Here’s an example to make things clearer:

*black and Scholes calculator(option pricing calculator)

| A | B | C | D | E |

|---|---|---|---|---|

| Type of option | Original delta | Gamma | New delta if the share price increases by Re. 1(B+C) | New delta if the share price increases by Re. 1(B+C) |

| Call | +0.50 | +0.05 | +0.55 | +0.45 |

| Call | +0.10 | +0.02 | +0.12 | +0.08 |

| Put | -0.25 | +0.04 | -0.21 | -0.29 |

| Put | -0.40 | +0.10 | -0.30 | -0.50 |

Theta:

The premium you pay for an options contract is made up of two parts: extrinsic value and intrinsic value.

The extrinsic value of an option is made up of its time value and implied volatility. As the contract's expiration date approaches, the time value of an option diminishes. As a result, the extrinsic value decreases. As a result, the premium (or option price) decreases. This is known as time decay, and the option theta aids in calculating it.

Premium of an option = extrinsic value + intrinsic value

Theta is defined as the daily price decay of an option as the expiry date approaches. It aids in calculating the predicted drop in option premium with each passing day. Let's look at an example to better comprehend this notion.

| A | B | C | D |

|---|---|---|---|

| Initial price of the option (in rupees) | Theta | Expected option price after 1 day (A-B) | Expected option price after 10 days [A-(B x 10)] |

| 10.00 | -0.25 | 9.75 | 7.50 |

| 2.50 | -0.05 | 2.45 | 2.00 |

| 1.00 | -0.01 | 0.99 | 0.99 |

Vega

Vega is a measure of an option's price sensitivity to changes in the underlying asset's volatility. Vega is the amount by which the price of an option contract varies in response to a 1% change in the implied volatility of the underlying asset.

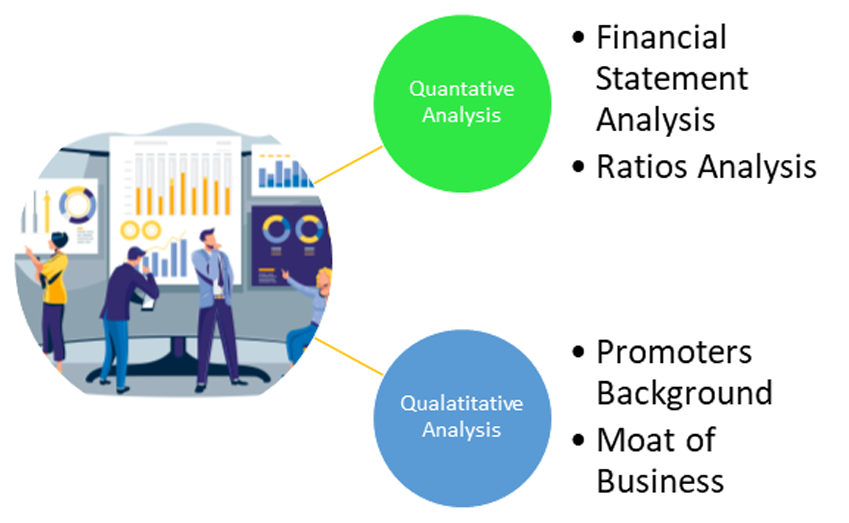

Fundamental Analysis

Fundamental analysis (FA) is a method of measuring the intrinsic value of a security by examining the relevant economic and financial factors. Fundamental analysts investigate everything that can affect the value of a security, from macroeconomic factors such as economic and industry conditions to microeconomic factors such as the effectiveness of corporate governance.

The ultimate goal is to reach a number that allows investors to see if a security is undervalued or overvalued compared to the current price of the security.

If an investor wants to invest in a company over the long term (e.g. 3-5 years), it is essential to understand the company from different perspectives. It is important for investors to isolate the daily short-term noise of stock prices and focus on the underlying performance. In the long run, the stock prices of fundamentally strong companies tend to rise, bringing wealth to investors.

Quantitative and qualitative fundamental analysis

In fundamental analysis, experts use both quantitative and qualitative aspects to determine the intrinsic value of a stock. The following are associated with these aspects:

Quantitative aspects of fundamental analysisThis is information that can be quantified by numerical values such as company sales, profits, liabilities, and assets.

- • What is the enterprise`s revenue?

- • How a whole lot earnings has it made withinside the beyond year?

- • How a whole lot capital does it have

- • How is the enterprise the usage of its cash?

- • What does the enterprise spend on?

- • How a whole lot debt does it owe its creditors?

These are more abstract details such as the company's credit, the patent in its name, and the company's own technology.

- • How efficient are the enterprise`s operations?

- • What is the excellent of its key control personnel?

- • How much is the brand value of the company?

- • Does the enterprise use any proprietary technology?

- • What socially accountable tasks is the enterprise undertaking?

- • What is the enterprise`s imaginative and prescient like for the future?

Tools for Fundamental Analysis

The tools needed for fundamental analysis are basic and most of them are free to use. Specifically, you will need the following:

- • Company Annual Report-All information required for FA can be found in the Annual Report. The annual report can be downloaded free of charge from the company's website.

- • Industry Data – Industry data is needed to see how the companies being reviewed are performing well in their relationships with the industry. Basic data is available free of charge and is usually published on trade association websites.

- • News-Daily News helps you stay up-to-date on the latest developments in your industry and interested companies. Services like good business newspapers and Google Alerts help keep you up to date with the latest news

What is an annual report?

The Annual Report (AR) is the company's annual publication and is sent to shareholders and other stakeholders. The annual report is published at the end of the fiscal year and all data provided in the annual report is dated March 31. AR is usually available as a PDF document on the company's website (investor section). Alternatively, you can contact the company to get a hard copy of it. From the company's annual report, anything listed in Annual Report is considered official. Hence, any misrepresentation of facts in the annual report can be held against the company. To give you a perspective, AR contains the auditor`s certificates (signed, dated, and sealed) certifying the sanctity of the financial data included in the annual report.

Potential investors and the present shareholders are the primary audiences for the annual report.

Infosys annual report 2019-2020

Annual reports should provide the most pertinent information to an investor and communicate its primary message. For an investor, the annual report must be the default option to seek information about a company. Of course, many media websites claim to give financial information about the company; however, the investors should avoid seeking information from such sources. Remember the information is more reliable if we get it to get it directly from the annual report.

Why would the media website misrepresent the company information you may ask? Well, they may not do it deliberately, but they may be forced to do it due to other factors. For example, the company may like to include `depreciation` in the expense side of P&L, but the media website may like to include it under a separate header. While this would not impact the overall numbers, it does interrupt the overall sequencing of data.

Contents of the company's annual report

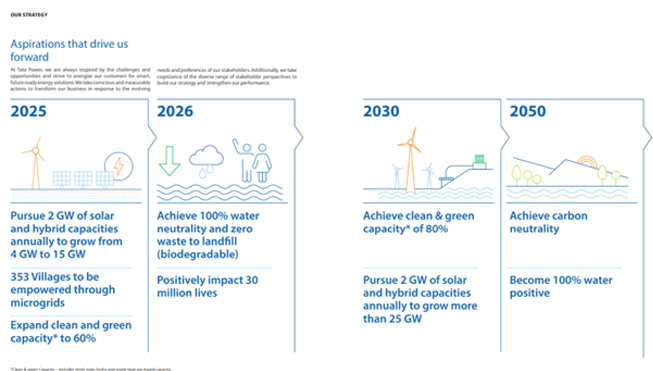

As you know, the format of the company's annual report is not fixed. This depends on the company. The order of the content can vary, but the core topics of the report are usually the same across organizations. Let's start with the overview section and take a look at the contents of the TATA Power Annual Report.

OverviewThis section of the report provides investors with brief insights into various aspects of the company. Here are some of the subcategories in this section:

1. About the Company

Under this heading, there is usually a short history of the company, including highlights for the past year. In the case of TATA Power, they also talked about brand and product scope, supply chain indicators, and a variety of other information.

2. Chairman's ReportThe Chairman's Report is intended for shareholders of the company and provides information on the development of the company over the past year. In TATA Power’s annual report, the chairman of the company spoke extensively about the company's performance, performance and industry trends.

3. Board of DirectorsThis subsection basically introduces the company's board of directors to shareholders. Includes the name of the director, his position within the company, and his portrait.

4. Management CommitteeThe Management Committee is a group of senior executives responsible for various activities within the company. This subsection contains the names of the members of the committee and their position within the company, as well as their portraits.

5. Company PerformanceThis subsection provides highlights of the company's performance over the past year. This includes both financial and non-financial key performance indicators.

6 Macroeconomic Situation and OutlookThis section of the company's annual report provides an overview of the industries in which the company operates. It also contains information about key trends and economic conditions that affect the company and its stakeholders, and the actions that the company is taking to mitigate the impact. This department. It also outlines both the business and non-business strategies that the company pursues to fulfil its vision and mission.

7. Corporate StrategyThis section contains the company's vision and mission statement. It also outlines both the business and non-business strategies that the company pursues to fulfil its vision and mission.

A brief draft or sketch of the company's business model is usually referred to in this section.

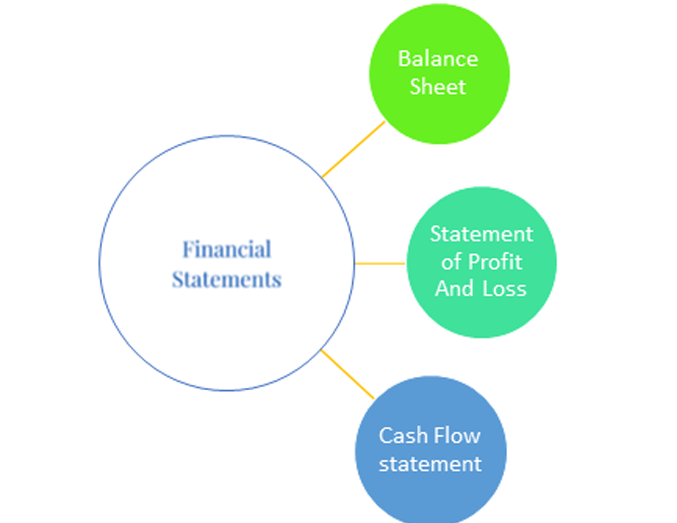

Financial Statements

So far, we have only dealt with the qualitative aspects of a company's annual report. With the launch of the financial reporting section, we are officially moving to the quantitative side. Here are some of the company's financial statements that you may encounter in this section of the report:

1. Standalone financial statements

These financial statements relate to a major entity that is Hindustan Unilever Limited in our case. The following are the steps detailed in this section. In the next chapter, you will learn more about how to read and analyse these statements

- o Independent auditors’ report

- o Balance sheet

- o Statement of profit and loss

- o Statement of changes in equity

- o Statement of cash flows

- o Notes

2. Consolidated Financial Statements

In general, if a company has one or more subsidiaries, prepare consolidated financial statements that include financial information for the parent company and its subsidiaries / subsidiaries. It is created in addition to the separate financial statements

- o Consolidated independent auditors’ report

- o Consolidated balance sheet

- o Consolidated statement of profit and loss

- o Consolidated statement of changes in equity

- o Consolidated statement of cash flows

- o Consolidated notes

- o Form AOC-1

Others

This section consists of other information and generally contains the following information:

- o Awards and recognition

- o Corporate information

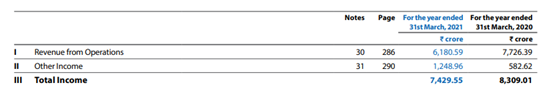

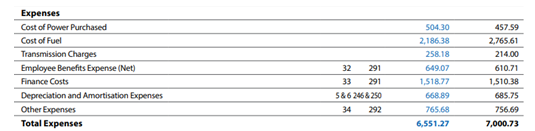

The profit and loss statement

This is a snapshot of the Tata Power’s income statement from the 2020-2021 annual report. Please read this statement carefully as it is important to understand the layout and structure of your income statement.

Breakdown of profit and loss statement

IncomeIt consists of two major parts

- 1. Revenue from operations: -

You may have heard analysts talking about the company's bottom line. They refer to the revenue side of the income statement. The revenue side is the first number group that the company displays on the income statement.

- 2. Other Income

Expenses are generally categorized by a feature, also known as cost of goods sold, or by the nature of the expense. A list of costs can be found in the income statement or in the appendix. As you can see in the excerpt below, almost all line items have notes associated with them.

This is the net operating profit after deducting operating expenses and before deducting taxes and interest. Continuing the income statement, you can see that TPCL mentions pre-tax profit and an exceptional number of positions.

Net operating income after tax is defined as operating income after deducting liabilities. Now let's look at the last part of the income statement, profit after tax. This is also known as income statement revenue.

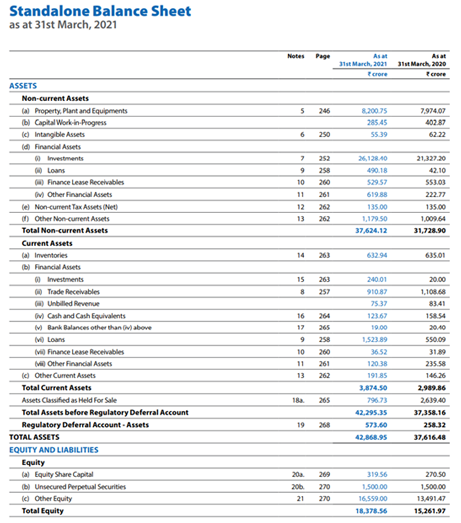

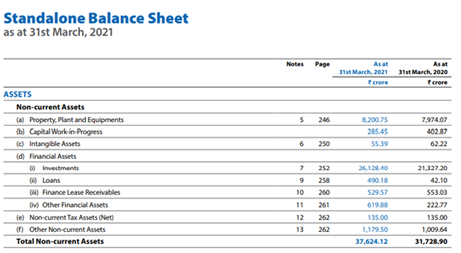

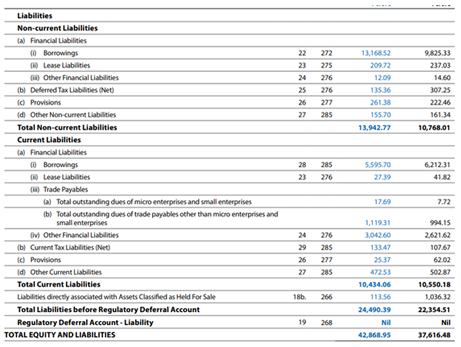

Balance Sheet

The income statement provides information about a company's profitability, while the balance sheet provides information about assets, owners, and capital. As you know, the income statement deals with the profitability of the fiscal year under review. Therefore, it can be said that the income statement is self-contained. However, because the balance sheet is flow-based, it contains financial information from the time the company was established. Therefore, P & L talks about the company's performance in a particular fiscal year. The balance sheet, on the other hand, shows how the company has grown financially over the years.

Assets

The assets side of the balance sheet consists of two main categories:

- 1. Current Asset

- 2. Non-Current Assets

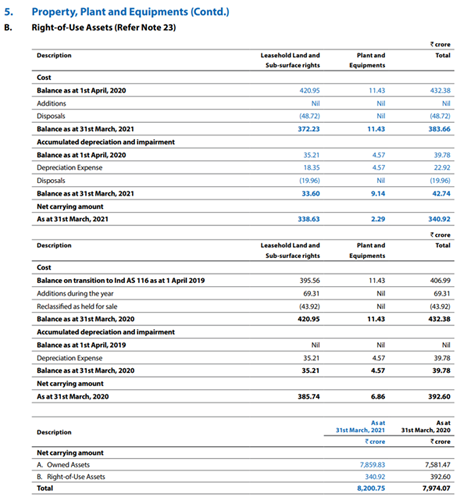

Non-Current Assets, often known as long-term investments, are assets that a corporation holds for more than a year. Non-current assets cannot be turned into cash easily or fast. The following non-current assets can be seen in Tata Power's balance sheet.

This line item includes all fixed assets owned or leased by the company, such as land, buildings, plant and equipment, furniture and fixtures, and other office equipment. Note 5 is associated with it which reveals all property , plants and equipment owned/ leased by TPCL

Capital work-in-progress includes all costs involved with the production or building of a fixed asset (CWIP). For example, capital work-in-progress refers to all costs incurred by a corporation in the development of a structure.

Goodwill and other intangible assetsA company's goodwill is essentially its reputation developed over many years of operation. It is typically quantified and presented as an intangible asset on a company's balance sheet.

Financial assetsAll of the company's long-term investments in subsidiaries, affiliated companies, and joint ventures are considered financial assets. Long-term savings, financial market investments, and loans to other businesses are all included.

Non-current tax assets and deferred tax assetsNon-current tax assets and deferred tax assets are two types of long-term assets that can be used by a firm to lower its taxable revenue at a later period. Overpayment of taxes or advance payments of taxes, for example, are categorised as non-current tax assets because they can be utilised to decrease the company's tax burden at a later point.

Other non-current assetsOther non-current assets are used to classify all other ancillary and miscellaneous long-term assets that do not fit into any of the above-mentioned categories.

Current assetsCurrent assets are a company's assets that are expected to be converted into cash within a year. They're also known as short-term assets because they can be sold or converted into cash quickly.

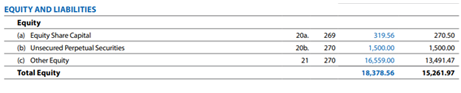

Equity and liabilities

A balance sheet's equity and liabilities are divided into three groups.

- 1. Equity

- 2. Non-current liability

- 3. Current Liability

The following two subdivisions make up the equity heading.

Equity share capital:The whole paid-up value of a company's equity share capital is shown as equity share capital. The notes to financial statements section contains a full breakdown of the equity share capital, including the number of permitted equity shares, the number of issued and paid up equity shares, and the face value of the shares.

Other equity:Other equity balances, such as securities premium and outstanding employee stock options, make up this category. This page also contains all of the company's other reserves, such as capital reserve, capital redemption reserve, and retained earnings. The notes section also contains a breakdown of the various elements under the 'other equity' column of the balance sheet.

LiabilitiesThe liabilities area of the balance sheet is divided into two sub-categories, similar to the assets section.

- • Non-current liabilities

- • Current liabilities

Non-current liabilities are a company's financial obligations that are not expected to be paid off within a year. Non-current liabilities are difficult to settle and settle fast. The following non-current liabilities can be found in HUL's balance sheet.

Financial liabilitiesThese financial liabilities are a company's long-term debt obligations that must be repaid. Other financial liabilities include ancillary and miscellaneous financial liabilities such as leasing liabilities, employee-related liabilities, and security deposits.

ProvisionsIn its books of accounts, a firm usually makes a provision for an existing or current liability. The corporation is then expected to pay up these provisions in the future. This tab of the balance sheet contains all of the long-term provisions.

Non-current tax liabilitiesNon-current tax liabilities consist of long-term tax liabilities that are required to be borne by the company, but have not yet been paid

Current liabilitiesCurrent liabilities are a company's liabilities that are expected to be paid back within a year. They're also called short-term liabilities because they're usually repaid within a year.

Financial liabilitiesThese financial liabilities, unlike non-current financial liabilities,

include all of a company's short-term obligations. They also contain

trade payables, which are payments that are owed to a company's

suppliers.

Other financial liabilities include supplementary and other short-term

liabilities such as unpaid dividends, salaries, wages, bonuses, and

current leasing payments.

Other current liabilities are used to classify current financial commitments that do not fit into any of the above-mentioned categories. This category includes customer advances as well as statutory dues such as tax deducted at source (TDS) and provident fund payments.

ProvisionsThis tab of the balance sheet contains all of the short-term and current provisions.

Total liabilitiesThe figures on a company's 'equity and liabilities' side of the balance sheet are then added together to get 'total equity and liabilities.

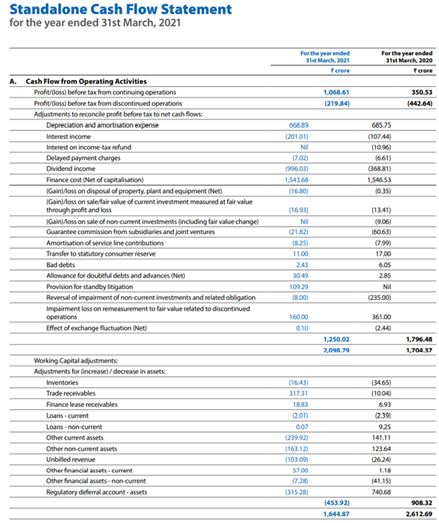

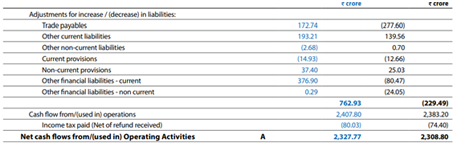

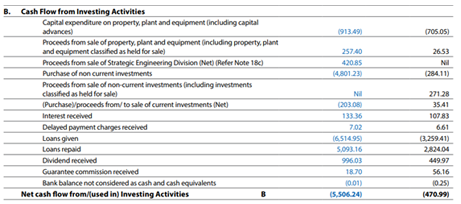

The Cash Flow statement

The cash flow statement is an important financial statement since it shows how much money the company generates. You could wonder why this information isn't included in the P&L statement.

Both cash and credit sales are recognized in the profit and loss statement. If the majority of a company's sales are made in credit, the revenue is recognized, but there is no subsequent cash inflow to the company. This can distort the perception of the company

The cash flow statement, as the name implies, summarizes the source and use of cash during the period and calculates the net fluctuations in the company's cash (and cash equivalents). Each entry in the cash flow statement falls into one of three categories:

Operating activities: Cash flows related to the company's key business functions.

Investment activity: Cash flow from the purchase or sale of fixed assets (plants, tangible fixed assets, etc.).

Financing activities: Cash flows related to a company's financial activities (borrowing from banks, issuing bonds, selling or repurchasing shares, etc.)

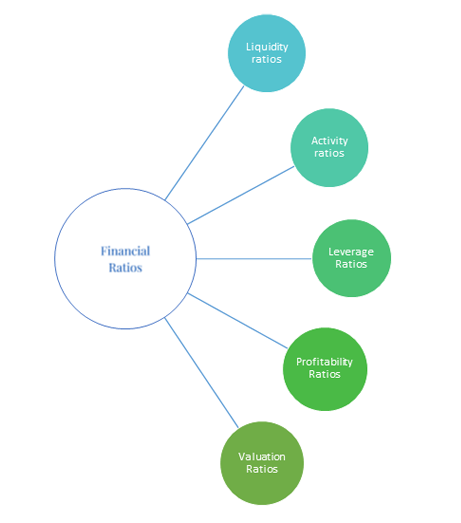

Financial Ratios

In many cases, it is easier to calculate the relationships between the various elements of a financial statement rather than looking at individual data points. There are several standardized financial indicators that are used to assess factors such as a company's profitability, efficiency, liquidity, growth potential, and risk. Metrics provide useful information about individual companies and facilitate comparisons between companies of different sizes.

Financial ratios can be classified into different categories, namely:

- 1. Liquidity Ratio

- 2. Activity Ratios

- 3. Leverage Ratios

- 4. Profitability Ratios

- 5. Valuation Ratios

Liquidity Ratio

This indicator provides information about a company's ability to meet short-term financial obligations. This is done by comparing the company's most liquid assets (or assets that can be easily converted to cash) with their current liabilities. In general, the better the cash and short-term debt match, the better the result, as it clearly shows that the company can pay off the debt to be paid in the near future and fund the ongoing business. Companies with low coverage, on the other hand, need to signal investors as they can be a sign that they are having a hard time doing business and fulfilling their debt. The biggest difference between each metric is the type of asset used in the calculation. Each ratio includes current assets, but some liquid assets are excluded because the more conservative ratios are not easy to convert to cash.

Current RatioThe current ratio is a liquidity ratio that assesses a company's capacity to pay short-term or one-year obligations. It explains to investors and analysts how a firm might use current assets on its balance sheet to pay off current debt and other obligations.

Current Ratio= Current Assets/Current Liabilities Quick RatioQuick Ratio = Cash & Equivalents+ short-term investments+ accounts receivables/ Current Liabilities

Operating Ratios

Operating Ratios, also known as "activity ratio" indicate the efficiency of a company's operations. This is another commonly used liquidity indicator related to sales, which indicates how fast goods and payments enter and leave the business, or how quickly non-cash assets are converted. Can be considered to cash. Basically, these key figures show how companies can use their resources efficiently and effectively to generate sales and increase shareholder value. In general, the better these indicators are, the better they are for shareholders.

Inventory Turnover RatioInventory turnover refers to how many times a company's inventory is emptied and replenished during the course of creating the commodities it sells. It compares the total amount of raw materials consumed in a given period to the average amount of inventory kept (COGS).

If a company sells popular products, the goods in its inventory are quickly depleted, and the company must refill the inventory on a regular basis.

Inventory turnover = Cost of goods sold/ Average inventory

Payables Turnover Ratio-This metric indicates how long it takes the company to pay off its accounts payable (in fractions of a year), with days in accounts payable matching to the number of days in the accounting period.

Payables turnover = Cost of goods sold/ Average accounts payable

Receivables Turnover Ratio-Receivables turnover is a metric that indicates how long it takes customers to pay the company in fractional years and days in accounts receivable. A greater figure, of course, suggests that the company collects cash more frequently.

Receivables turnover = Net sales/ Average receivables

Fixed Asset Turnover RatioThis ratio is an approximate estimate of a company's fixed assets' productivity in terms of generating revenue (property, plant, and equipment, or PP&E). Fixed assets are typically the single greatest component of a company's overall assets. This annual turnover ratio is calculated to show a company's efficiency in handling these valuable assets. To put it another way, the larger the annual turnover rate, the better.

Fixed Assets Turnover = Net Sales / Total Average Asset

Leverage Ratios

This series of ratios looks at how leverage (also known as gearing) affects a company's risk. Borrowing money enhances a company's potential returns, but it also raises the company's risk and the potential for earnings fluctuation from one period to the next.

Interest Coverage Ratio : The debt service ratio or debt service coverage ratio is another name for the interest coverage ratio. The interest coverage ratio tells us how much money the company makes compared to how much money it owes in interest. This ratio tells us how easy it is for a corporation to pay its interest. For example, if the company's interest burden is Rs.100 and its income is Rs.400, we can be confident that the company would be able to discharge its debt. A low interest coverage ratio, on the other hand, may indicate a bigger debt burden and a higher risk of bankruptcy or default.

Interest Coverage Ratio = EBIT/ Interest expense

Debt to Equity Ratio: This is a simple ratio to understand. The Balance Sheet contains both of the variables needed for this calculation. It calculates the total debt capital as a percentage of total equity capital. This ratio has a value of 1 if the debt and equity capital are equal. A larger debt-to-equity ratio (more than 1) suggests greater leverage, and so caution is advised. A value less than one suggests a larger equity foundation in relation to debt.

Debt Equity Ratio = [Total Debt/Total Equity]

Financial Leverage RatioThis figure represents the proportion of total assets to total equity. This compares the complete asset base on the balance sheet's left side to simply the fraction of shareholders equity that belongs to common shareholders. The firm's financial leverage, from the perspective of common shareholders, evaluates how much "things" the company has in comparison to how much money they have invested.

Financial Leverage = Total assets/ Total common equity

Profitability Ratios

Profitability ratios assist analysts in determining a company's profitability. The ratios indicate how well a corporation may perform in terms of profit generation. The profitability of a corporation also reflects the management's competitiveness. Profitability is a crucial aspect since earnings are required for business expansion and dividend payments to shareholders.

Gross Profit MarginIt's essentially the profit margin on the company's products, less any production-related indirect costs. The cost of goods sold (COGS) of a corporation represents the costs of labour, raw materials, and manufacturing overhead incurred during the production process. This cost is subtracted from the company's net sales/revenue, yielding the first level of profit, or gross profit.

The gross profit margin is a metric that measures how effectively a corporation uses its raw materials, labour, and manufacturing-related fixed assets to generate profits. A larger profit margin % is a positive indicator.

Gross profit margin = Gross profit/Net sales = (Net sales - Cost of goods sold) / Net sales

Operating Profit Margin/EBIDTA MarginOperating income is calculated by subtracting selling, general, and administrative, or operating expenses from a company's gross profit. Operating expenses are far more under management's control than cost of sales expenditures. As a result, investors must carefully examine the operational profit margin.

The majority of positive and negative developments in this ratio may be traced back to managerial decisions. When conducting inter-company comparisons and financial projections, investment analysts frequently prefer to use a company's operational income figure rather than its net income figure (since it is regarded to be more dependable).

Operating profit margin = Operating profit/ Net sales

Operating Profit = (Net sales - COGS - SG&A expense - D&A) /Net sales

Return On EquityThis is the most important of all financial ratios and the most meaningful measure of return to common stockholders. The return on equity (ROE) quantifies how much a company earns in comparison to the total amount of money left to it by common shareholders (either as paid-in capital from previous share issuances or retained earnings from prior periods).

Return on equity = PAT/Shareholders Fund

Return on Asset (ROA)The ROA is a ratio that compares a company's net income to its total asset base (the entire left side of the balance sheet). This metric measures a company's profitability in relation to its total assets. The return on assets (ROA) ratio shows how well management uses the company's total assets to generate profit. The higher the return, the more effectively management uses its asset base.

Return On Assets = Net income/Average total assets

Return On Capital Employed (ROCE)Except for current obligations, a company's capital employed is everything on the right side of the balance sheet. All long-term funding, minority interests, and shareholders' equity are included. The left side of the balance sheet is used as the reference (because both sides must be equal) and capital employed is defined as:

Capital employed = Total assets - Current liabilities

ROCE = EBIT/ Capital employed

Valuation Ratio

In general, valuation is the estimation of something's 'value.' The price of a stock is referred to as "something" in the context of investments. Regardless of how appealing a business appears, the valuation of the firm is ultimately what matters when making an investment decision. The amount you pay to buy a firm is determined by valuations. A mediocre business with a crazily low valuation might sometimes be a better investment than an interesting business with an incredibly high valuation.

Price to sales ratioThe Price-to-Sales Ratio (P/S) compares the value of a company to the total amount of annual sales it generated previously. The P/S ratio, often known as the "sales multiple," is a valuation multiple based on the market value that investors place on a company's revenue.

Price/Sales Ratio= Market Capitalization/ Annual Revenue

Price to book valueThe Price-to-Book Ratio (P/B Ratio) compares a company's market capitalization to its book value of equity. The P/B ratio, popular among value investors, can be used to find cheap companies in the market.

Price-to-Book Ratio (P/B) = Market Capitalization / Book Value of Equity

Price to earningThe price-to-earnings ratio is a metric that represents a company's profit potential. The value paid by equity investors for each stock unit is used to calculate this potential. As a result, it shows whether a stock is cheaper or more expensive than its competitors in the same industry. In order to track the company's growth, the current price-to-earnings ratio can be compared to previous ratios.

P/E Ratio = Share Price/Earnings Per Share

Personal Finance Basics

When you think about personal finance, you frequently think about organising your finances today so that you can have a better tomorrow. While some assume they can do it themselves, few seek a financial expert to set this course for them. However, I'm not a supporter of seeking a financial planner to assist you map out a strategy for yourself and your family. You and your family should be able to achieve this.

After all, you are the most familiar with your family and their needs. You understand what is beneficial to the family and what is not. You work hard for your family now and wish for them to have a stable future.

Your 'Financial Advisor' will not do any of this.

He is most likely ready to sell you a financial product that will make him a good profit. He will do the same for you and any other 20 clients he may have.

But you should take help of a good financial advisor when you want to invest into instruments about which your understanding is very little.

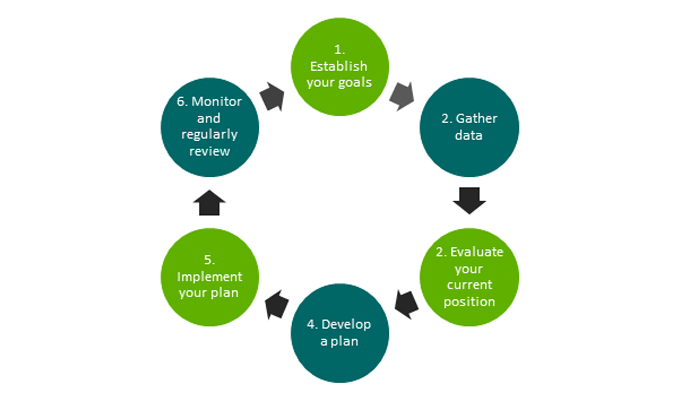

This module will guide you to the process of financial planning from an individual’s perspective.

In bookish terms financial planning is an ongoing process to help you make sensible decisions about money that can help you achieve your goals in life, which is pretty much true as you can’t live without money , unless you are a monk who has renunciated everything.

Being a process there are some steps involved with it,

Process:

At foremost before making any financial plan you need to establish your goals

For sake of understanding these could be your list of goals

- 1. To buy a luxury car.

- 2. To buy a vacation/first home.

- 3. Your daughter’s marriage

There could be as many as you like to add to your list but remember to be sensible, you can’t make goals like buying land on mars (until elon musk or someone else make that possible).

After making those goals try to gather information about how much it will cost you to achieve those goals, remember you have to take care of every expect of it

For buying a luxury car you need a corpus of around 50,00,000 at least; for buying a decent 4-5 BHK home for your family or to build an independent home even in your home town or whether you want to buy a vacation home at a decent place you will require a corpus of around 1-4 crore.

The big fat Indian wedding will cost you around 1,00,00,000 or even you and your daughter have decided to make it a normal budget friendly ceremony you still have to keep a budget around 50,00,000. (These figures are just estimations you have to gather this information by yourself ; monetary figures are totally subjective in nature).

After you have decided the figures, analyse you current financial position, for that you may use your our calculators such as:

Net worth calculatoras you have correctly estimated the figures you now need to develop a plan, again let’s assume your children are young and you want to save money for their future it could be for marriage, it could be for their education and it could be to help them settle a business. You will require funds in each of these cases once they are grown up (which we are here assuming here to be 20 years).

Now to attain your goals as we have learnt earlier, we need to estimate figures

Assuming we will require around 30,00,000 in todays value to achieve any of these goals after 20 years the same will cost us 8,751,139.10 owing to inflation of around 6.5%.

Now to achieve these goals you need to make a plan that how much you need to invest over a span of 20 years to generate equivalent or greater than the required amount. For which you may use our calculators such as

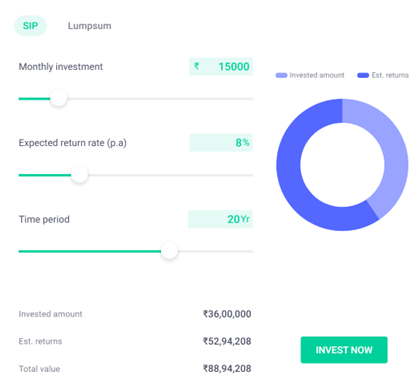

Investment planner calculators Sip calculator

You can make a sip of as little as 15000 at very moderate return of just 8% over 20 years to generate such returns.

Now to really generate such returns you need to implement the plan; you need to find out which particular instrument can provide you returns you need with least downside risk.

After you have implemented the plan, you need to regularly evaluate your performance, for that you need to understand financial planning pyramid

Financial Planning Pyramid

All of these elements are equally important.

Wealth Protection:Ideally, you should begin your financial planning with Protection Planning. You must first safeguard 'What you have.' It could be your life, health, property, vehicles, and so on. Plan for adequate insurance coverage and purchase the appropriate products to cover the risks associated with all of this. Another critical point is to 'establish and maintain an Emergency Fund.' This can range from 3 to 6 months of your monthly living expenses. However, do not invest this fund in high-risk investments. The main goal of keeping this fund is to have cash on hand in case of an emergency. Aside from these two points, you can focus on keeping a monthly budget. Keep track of your monthly cash inflows and outflows.

Wealth Creation: Most of us are more concerned with 'how to create wealth.' Without a doubt, this is an important aspect of your financial strategy. However, accumulating without a proper protection plan can be costly when faced with adversity. After you've created a good protection plan, you should create a list of realistic financial goals. Examples of accumulation goals include 'creating a corpus for retirement,' 'kids' education goals,' 'purchasing a property,' and so on. Choose appropriate investment products based on the timeframe of your objectives. For long-term goals, do not be afraid to invest in risky products such as mutual funds or stocks. Once you've allocated your savings to each goal, keep an eye on your portfolio. Change your asset allocation (debt vs equity) as needed.

Wealth Distribution: It is also referred to as Estate Planning. It is one of the most overlooked aspects of financial planning. Assume you have a good protection plan in place as well as good wealth accumulation strategies. But what is the point of constructing assets and purchasing insurance policies if you have not made proper nominations on your investments? If the head of the family dies without leaving a Will or without naming the nominees, the legal heirs face a difficult task in accessing the investments/assets. Estate planning is the process of making a plan ahead of time and naming who you want to inherit your possessions after you die.

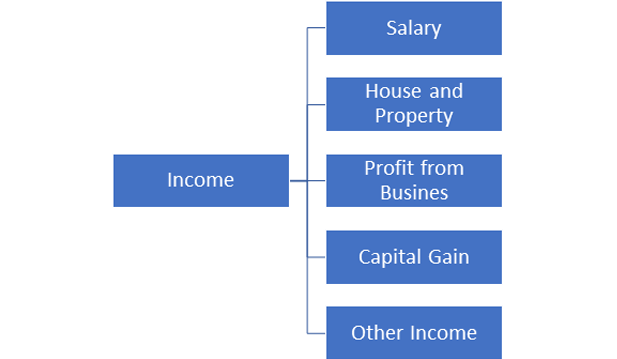

Cash Flow Analysis (Current Status)

As simple as it sounds, you need to analyse your cash flow position; it can be on monthly basis, yearly basis or even quarterly basis. Monthly basis would be most suitable for you if you are an employed person, for traders like us quarterly basis could be perfect, and for business owner’s yearly basis can be suitable, again it is up to you to select but remember the rational should be recurring of your inflows or outflows.

For sake of easy understanding let’s say you are an employee of ZXY and apart from that you have an ancestral property In your home town, let’s see your cash flow position as follows

| Salary Income | 1,20,000/pm |

| Income from property | 25,000/pm |

You are a family of four and have a monthly cash outflow of 85,000/ pm.

| Grocery Bills | 10,000 |

| Medical Expenses | 7,000 |

| Fuel Bills | 8,000 |

| Education Expenses | 10,000 |

| Home Loan EMI | 35,000 |

| Other Expenses | 15,000 |

So you have a cash balance of 60000/pm isn’t it a healthy cashflow.

You need to consider your EMIs , bills and even taxes while calculating monthly cash outflows ;

And if you are doing this exercise consider only those payments or income which are recurring in nature, and always maintain a room for unexpected expenditures(as they too are recurring in nature but you almost never have any clue about them).

Current Asset Allocation

Asset allocation simply means how much you have allocated in any particular asset class. The pie chart above is just an illustration of asset allocation.

Consider anything to be an asset which provides a positive cashflow to you, liabilities on the opposite side is just opposite of an asset.

When you subtract all your liabilities from your asset you will get a figure which is your net worth.

Net Worth

All liabilities are subtracted from assets to determine net worth. Liabilities are obligations such as loans and mortgages, whereas assets are anything owned that has monetary value.

Net worth can be positive or negative, with the former indicating that assets outnumber liabilities and the latter indicating that liabilities outnumber assets.

Good financial health is indicated by a rising net worth. Declining net worth, on the other hand, is cause for concern because it could indicate a drop in assets compared to liabilities.

On a personal note, while calculating net worth first consider all your assets and all your liabilities, that will be your real net worth, but you can move a step further by considering only liquid assets, in this way you will eliminate noise and will have an accurate perspective of what is your liquid net worth is.

WHY? : Because you might have a property but let’s say you can’t sell it so in reality it has no real value to you or you own gym equipment or mobile phone try not to consider them while calculating your net worth.

Risk profiling

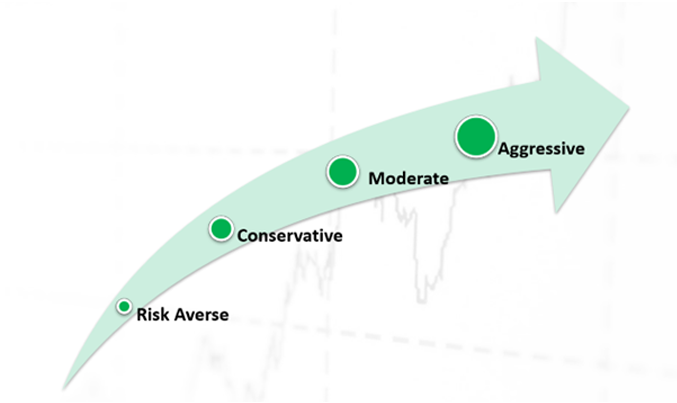

Risk profiling allows investors to assess themselves on various parameters in order to determine their risk-taking capacity and, as a result, allocate money to different asset classes.

Typically, risk profiling is carried out by a financial planner through a formal questionnaire-based process in which investors are asked questions about their risk-taking capacity and suitability. Age, dependents, financial commitments, investment horizon, liquidity requirements, loans/ liabilities, income stability, time horizon, and understanding of investments and financial markets are all important parameters to consider when determining an investor's risk profile , it allows investors to assess themselves on various parameters in order to determine their risk-taking capacity and, as a result, allocate money to different asset classes.

Typically, risk profiling is carried out by a financial planner through a formal questionnaire-based process in which investors are asked questions about their risk-taking capacity and suitability. Age, dependents, financial commitments, investment horizon, liquidity requirements, loans/ liabilities, income stability, time horizon, and understanding of investments and financial markets are all important parameters to consider when determining an investor's risk profile.

Your risk profile can be any among these: - • ConservativeA conservative risk profile denotes an aptitude that is significantly low in risk. Investors with this risk profile will prioritise investment options that provide corpus safety over all else. To conservative investors, the scale of returns is secondary as long as it is not negative. A conservative risk profile typically accounts for a short time horizon.

Treasury bills, corporate bonds, sovereign bonds, debt-based mutual funds, and other low-risk investment options are ideal for conservative or low-risk investors.

• ModerateModerate risk-takers typically strive for a balance of returns and risk. These individuals will seek high returns with a manageable level of risk. As a result, a moderate risktaker's portfolio will include a moderate proportion of equities as well as debt instruments for adequate risk dilution. Such risk-takers can also invest in equity-based mutual funds on their own.

• AggressiveThis risk-profile demonstrates the greatest willingness to withstand market volatility in the hope of earning exponential returns. Typically, these investors are experienced and well-versed in the ways of the stock market. Aside from that, such investors have a long-term investment horizon, which allows them to tolerate short-term volatility.

These investors prefer equities and typically have a healthy asset-liability balance; however, young people with sufficient disposable income may also fit this investment risk profile.

Emergency funds

So, for now you have assessed your risk profile, your cash flow and your financial goals but what if any uncertainty prevails what are you going to do at that time, will you break your fixed deposits or will you liquidate your investments, from personal experience liquidating your investments is excruciating.

And also, if you will keep liquidating your investments if any uncertainty prevails soon it is going to become a habit for you and that’s not good when you have an investment objective, so it is always better to be safe.

In order to avoid such consequences, we make emergency funds it can be used to deal with any emergency let be a medical emergency or you need to withdraw fund for you home renovation which wasn’t planned earlier. You need to consider that these kinds of expenses are always unexpected and can you would need to have a concrete cash balance to deal with them. For that you need to save aside a corpus every month and remember you can’t take huge risk with this amount.

You can keep 3-6 months as your emergency funds in cash or near cash investments like

- • Short Term Fixed Deposits

- • Sweep-in accounts

- • Short term Debt MF

As well as always have insurance.

Investment Planning for Goals

Goal based investing is most common when it comes to personal finance, and why it wouldn’t be why do we invest? to achieve some goals, let it be for a foreign trip, buying a car, higher education of your children or the biggest financial goal of all: financial freedom.

So, if we are setting a goal, we need a plan to achieve it and this is where certain things come to play like:

- • Net Present Value

- • Opportunity Cost

- • Future value of money

Let’s go one by one to understand each one of them

Opportunity Cost

Opportunity Cost simply means the cost you will incur if you will choose option A over option B.

For sake of understanding suppose you are travelling through the mountains and to reach a cliff you have two options to travel through car or to pick a bike.

If you pick a bike the pros will be that you will enjoy the surreal views of the valley but at the same time you have to bear the rough biking experience.

If you pick a car the pros will be the comfort but the experience won’t be the same, you won’t be able to click pictures at every spot where you want to as it will cause the traffic.

Here if you choose Bike the opportunity cost is comfort and if you have chosen car opportunity will be less pictures to post on Instagram.

In the same way when you invest the safety of funds is primary focus so if you are choosing equity to invest in the opportunity cost will be T-bills rate, as general public can’t directly invest into T-bills we consider the current inflation rate as the opportunity cost (as anyways if you are not going to invest you money will erode at this rate).

Opportunity cost = Risk free rate + Risk premium

Net Present Value

We all purchase assets in the hope that they will generate a reasonable return over time. For example, if I bought a plot of land today, I would expect it to be worth a certain amount in 15 years. The amount of money I will receive when I sell this piece of land in 15 years will be very different from the same amount today.

The concept of present value helps you understand the current value of funds you are likely to receive in the future.

Does that make sense? Most likely

Let us illustrate this with an example.

You buy a stock at 120 in 2008 and sold it for 960 in 2022, that translate into a 800% return over 14 years , but how much purchasing power does 960 have in todays value when compared to 120 in 2008.

This is a quite common question and all of you might have heard about it from you parents that they used to buy wheat for 2/kg and the minimum price for today is 24/kg if we are not considering any other things like quality what has caused the price of wheat to increase like this? It is opportunity cost for its producer or simply the inflation.

We use

Present value = Future value / (1+ discount rate ) ^ (time) to calculate the present value of money, if we put values into formula it would translate into =960/(1+6%)^14 =424.61 It means that 960 in 2022 will have same purchasing power as 424.61 in 2008. You can always use our calculators for the same.

Future Value of money:

If I will offer you to give you 1,00,000 today or 1,00,000 after 10 years what will you choose, obviously a wise man will choose the first option because money today is worth more than money tomorrow as it has an opportunity cost associated with it.

If we just reverse the formula for present value will get the formula for future value (it works on the principal of compound interest).

Now you need this things to consider before making any financial plan to achieve your goals , like I want to buy a Vacation home which cost me around 1,50,00,000 in today’s value home much it will cost me around 3,89,06,000 after 10 years owing to an opportunity cost of 10% .

So, in order to achieve it what do I need to invest 3,00,000 pm at around 13% p.a for 10 years or a lumpsum of 1,00,00,000 at 14.5 % for 10 years.

Doesn’t it sound crazy to invest such hefty amounts to buy an asset whose value is definitely going to appreciate after x years and if you have 1,00,00,000 to invest why don’t you buy land directly or have a debt mix with it.

Well these are your home work activity and it will help you to make better financial decision.

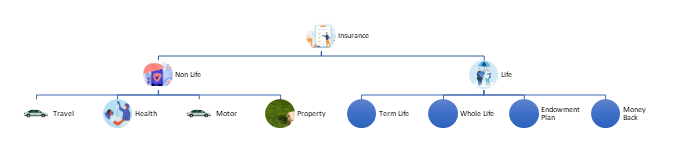

Insurance

Insurance is definitely a must have for you as you never know what could happen next, we will to understand very basics of insurance here, Broadly, there are 2ctypes of insurance, namely:

- • Life Insurance

- • General insurance

1. Life Insurance

Life insurance is a policy or cover that allows the policyholder to provide financial security to his or her family after death. Assume you are the family's sole breadwinner, supporting your spouse and children.

Your death would financially devastate your entire family in such a scenario. Life insurance policies prevent this from happening by providing financial support to your family in the event of your death.

The Different Types of Life Insurance Policies

When it comes to life insurance, there are primarily seven different types of policies. These are the following:

Term Plan - A term plan's death benefit is only available for a set amount of time, such as 40 years from the date of purchase.

Endowment Plan - An endowment plan is a type of life insurance policy in which a portion of your premiums is used to pay the death benefit and the rest is invested by the insurance company. Endowment policies provide assistance in the form of maturity benefits, death benefits, and periodic bonuses.

Unit Linked Insurance Plans, or ULIPs, are similar to endowment plans in that a portion of your insurance premiums is invested in mutual funds and the rest is used to pay out a death benefit.

Whole Life Insurance - As the name implies, these policies provide coverage for an individual's entire life, rather than just a set period of time. Some insurers may limit the duration of whole life insurance to 100 years.

Child's Plan - A life insurance policy with an investment component that provides financial assistance to your children throughout their lives. After the death of both parents, the death benefit is available as a lump-sum payment.

Money-Back - These policies pay out a set percentage of the plan's sum assured at predetermined intervals. This is referred to as a survival benefit.

Retirement plans, also known as pension plans, are a hybrid of investment and insurance policies. A portion of the premiums is used to build the policyholder's retirement fund. After the policyholder retires, this is available as a lump-sum or monthly payment.

Life Insurance BenefitsIf you have a life insurance policy, you can take advantage of the following benefits.

Tax Benefits - In India, you are eligible for tax benefits if you pay life insurance premiums under Sections 80(C) and 10(10D) of the Income Tax Act. By purchasing a life insurance policy, you can save a significant amount of money in taxes.

Encourages the habit of saving - Because you must pay policy premiums, purchasing such an insurance policy encourages you to save money.

Ensures Financial Independence for Your Family - The policy ensures your family's financial independence even after your death.

Assists in Retirement Planning - Some life insurance policies can also be used as investment vehicles. Pension plans, for example, provide a lump-sum payout when you retire, which can help you fund your retirement.

Now that you've learned everything there is to know about life insurance policies, keep reading to learn about the various aspects of other types of general insurance policies.

General insurance

Almost nothing can be insured. In India, however, general insurance is divided into four categories: fire, engineering, marine, and miscellaneous.

Let's take a look at them in terms of their utility and general acceptability. The following are the various types of general insurance available in India:

- • Health Insurance

- • Travel Insurance

- • Motor Insurance

- • Marine Insurance

- • Home Insurance

- • Commercial Insurance

Motor insurance refers to policies that provide financial assistance in the event that your car or motorcycle is involved in an accident. There are three types of motor vehicles for which insurance is available:

Car Insurance - This type of policy covers privately owned four-wheeler vehicles.

Two-wheeler Insurance - These plans cover personally owned two-wheeler vehicles, such as bikes and scooters.

Commercial Vehicle Insurance - If you own a vehicle that is used for business purposes, you must insure it. These policies ensure that your company's vehicles are kept in top condition, reducing losses significantly.

The Different Types of Automobile Insurance PoliciesMotor insurance policies are classified into three categories based on the amount of coverage or protection they provide:

Third-Party Liability - In India, this is the most basic form of motor insurance. According to the Motor Vehicles Act of 1988, it is the bare minimum requirement for all motor vehicle owners. Premiums for such policies are typically low due to the limited financial assistance. These insurance plans only cover the financial liability of the third-party involved in the accident, ensuring that you are not subjected to legal action as a result of the mishap. They do not, however, provide any financial assistance for the policyholder's vehicle to be repaired after an accident.

Comprehensive Coverage - Comprehensive insurance plans provide more protection and security than third-party liability plans. Apart from third-party liabilities, these plans also cover the costs of repairing the policyholder's own vehicle if it is damaged in an accident. Furthermore, comprehensive plans pay out if your vehicle is damaged due to fire, man-made and natural disasters, riots, and other similar events. Finally, if you have comprehensive coverage, you can recover the cost of your bike if it is stolen. With a comprehensive motor insurance policy, one can choose from a variety of add-ons to make it more complete. Zero depreciation coverage, engine and gearbox protection, consumable coverage, breakdown assistance, and other options are available.

Own Damage Coverage - This is a type of specialised motor insurance that insurance companies offer to customers. Furthermore, you can only get such a plan if you bought your two-wheeler or car after September 2018. It must be a brand new vehicle, not a repossessed vehicle. You should also keep in mind that you can only get this standalone own damage coverage if you already have a third-party liability policy. Own damage cover provides you with the same benefits as a comprehensive policy but without the third-party liability coverage.

Advantages of Automobile Insurance PoliciesAutomobiles and motorcycles are becoming more and more expensive with each passing day. Staying without proper insurance at this time can result in significant financial losses for the owner. Some of the benefits of purchasing such a plan are listed below.

Avoids Legal Trouble - Assists you in avoiding any traffic fines or other legal issues that you would otherwise have to deal with.

Financial Support for Repair Your Own Vehicle - After an accident, you will have to spend a significant amount of money to repair your own vehicle. Insurance policies limit such out-of-pocket costs, allowing you to get repairs done right away.

If your car or motorcycle is stolen, your insurance policy will help you reclaim a portion of the vehicle's on-road cost. If your vehicle is damaged beyond repair due to an accident, you can expect similar assistance.

Individuals who own a commercial vehicle or two-wheeler can also benefit from tax benefits if they pay premiums for that vehicle.

Health InsuranceHealth insurance is a type of general insurance that assists policyholders financially when they are admitted to hospitals for treatment. Some plans also cover the cost of treatment received at home prior to a hospitalisation or following discharge from one.

Health insurance has become a necessity in India due to rising medical inflation. Consider the various types of health insurance plans available in India before proceeding with your purchase.

Health Insurance Policies Types In India, there are eight different types of health insurance policies. They are as follows:

Individual Health Insurance (IHI) is a type of health insurance that covers only one policyholder.

Family Floater Insurance - These policies allow you to insure your entire family without having to purchase individual plans for each member. Under one such family floater policy, a husband, wife, and two of their children are usually covered.

Critical Illness Coverage - These are specialised health plans that offer substantial financial assistance to policyholders who have been diagnosed with certain chronic illnesses. Unlike traditional health insurance policies, these plans pay out a lump sum after a diagnosis.

Senior Citizen Health Insurance - As the name implies, these policies are designed for people over the age of 60.

Group health insurance is a type of policy that is typically offered to employees of a company or organisation. They are designed so that older beneficiaries can be removed and new beneficiaries can be added depending on the company's ability to retain employees.

Prenatal, postnatal, and delivery medical expenses are covered by maternity health insurance policies. It protects both the mother and her child.

Personal Accident Insurance - These medical insurance policies only cover financial liability for accidents that result in injuries, disability, or death.

Preventive Healthcare Plan - These policies pay for treatment that is aimed at preventing a serious disease or condition.

Health Insurance BenefitsAfter reviewing the various types of health insurance available, you may be wondering why getting one is so important for you and your family. Take a look at the list of reasons below to see why.

Medical Coverage - The main advantage of this type of insurance is that it provides financial protection against medical expenses.

Cashless Claim - If you seek treatment at one of the hospitals with which your insurance provider has a tie-up, you may be eligible for a cashless claim. This feature ensures that your insurer and hospital settle all medical bills directly.